how does doordash report to irs

For example if you suspect income tax fraud it wont help if you report it to the sales tax authority. If youre looking for past years tax brackets check out the tables below.

Doordash Taxes Does Doordash Take Out Taxes How They Work

Via this form you report all your annual income to the IRS and then pay income tax on the earnings.

. In general tax fraud falls into three categories. To ask for the details. You should try calling as soon as the IRS opens at 700 am.

Federal state and county. The IRS recently announced the 2022 tax brackets. Many people report that the best bet to call the IRS is in the early morning.

The College Investor does not include all companies or offers available in the marketplace. Make sure the person does not work under the person you suspect of fraud. Note that you need to report the earnings even if you dont receive the form.

Given many people are interested in the changes we wanted to include the latest tax bracket updates as quickly as possible. Any suspected fraud concerning income tax should be reported to the IRS. The IRS required DoorDash to send form 1099-NEC instead of 1099-MISC beginning in the 2020 tax year.

If not then find an appropriate person in management to report the fraud to. The Federal Tax ID Number or Employer Identification Number EIN for DoorDash is 46-2852392. Its pricing begins with a free version and goes to 4795 for self-employed taxpayers normally the most complex of tax scenarios.

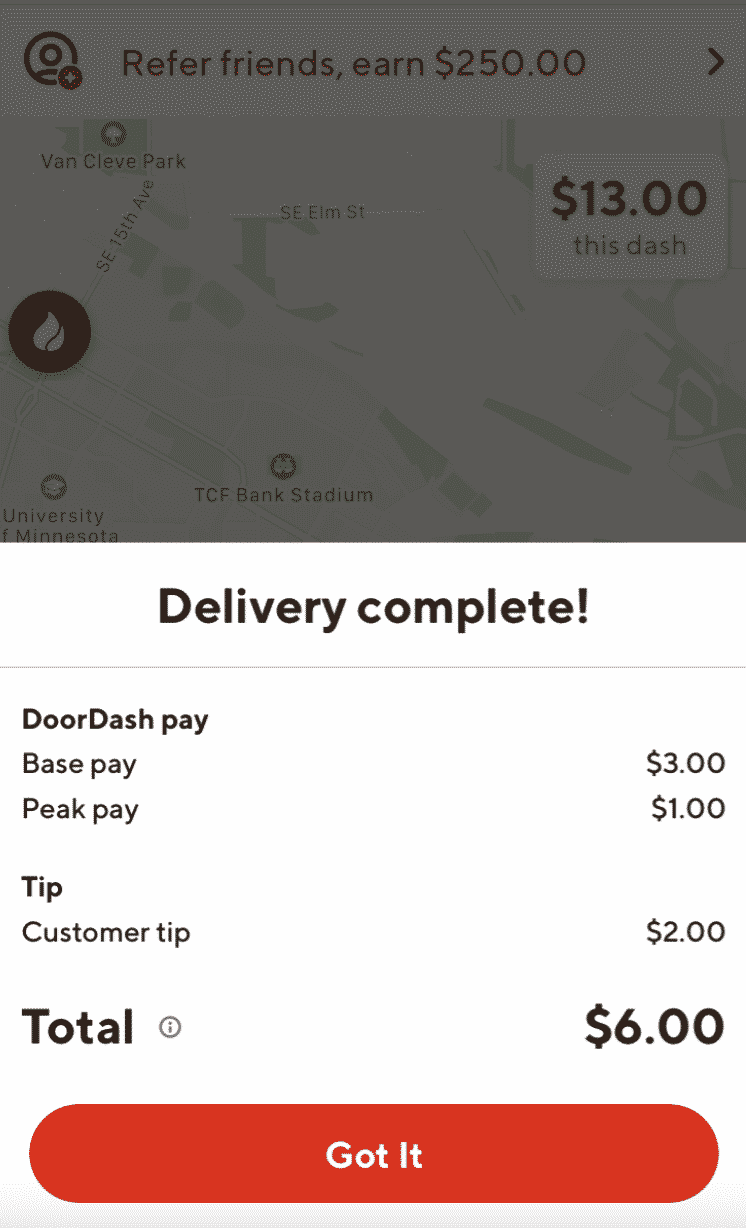

Check if there is a hotline you can call anonymously. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms. Our partners compensate us.

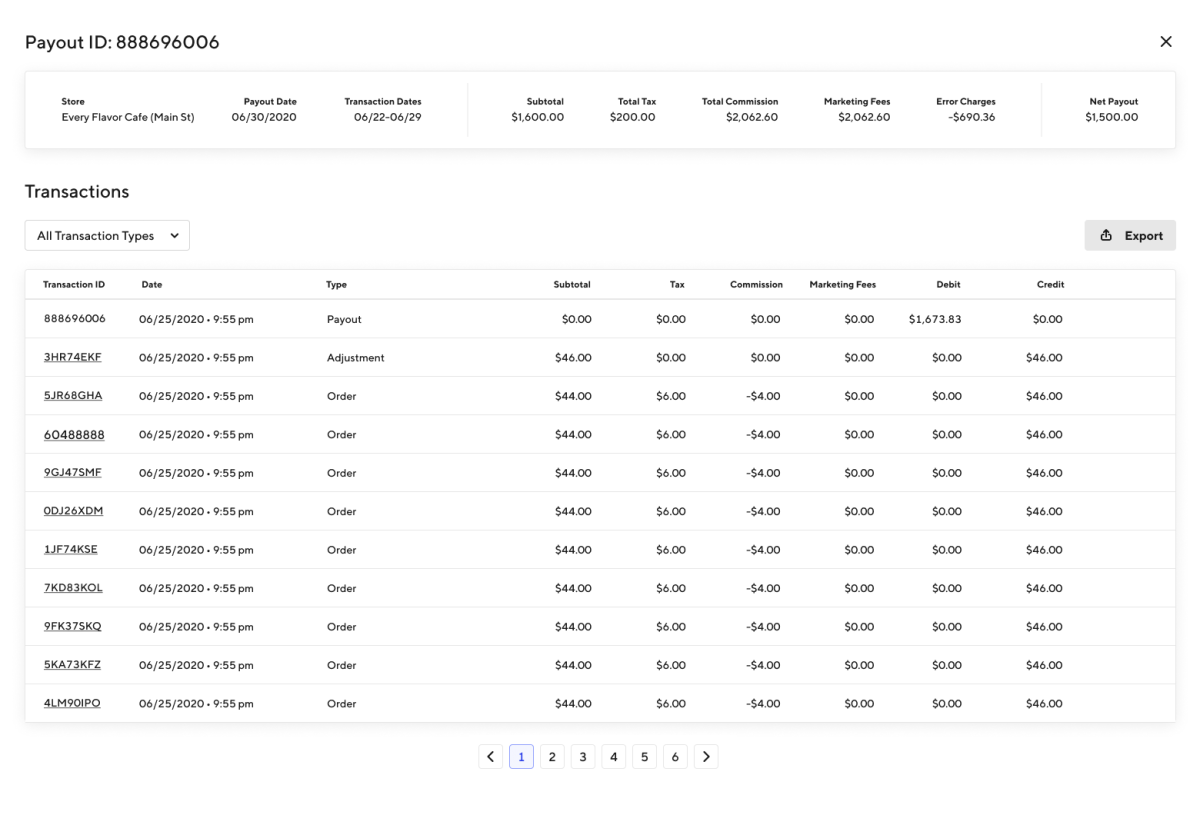

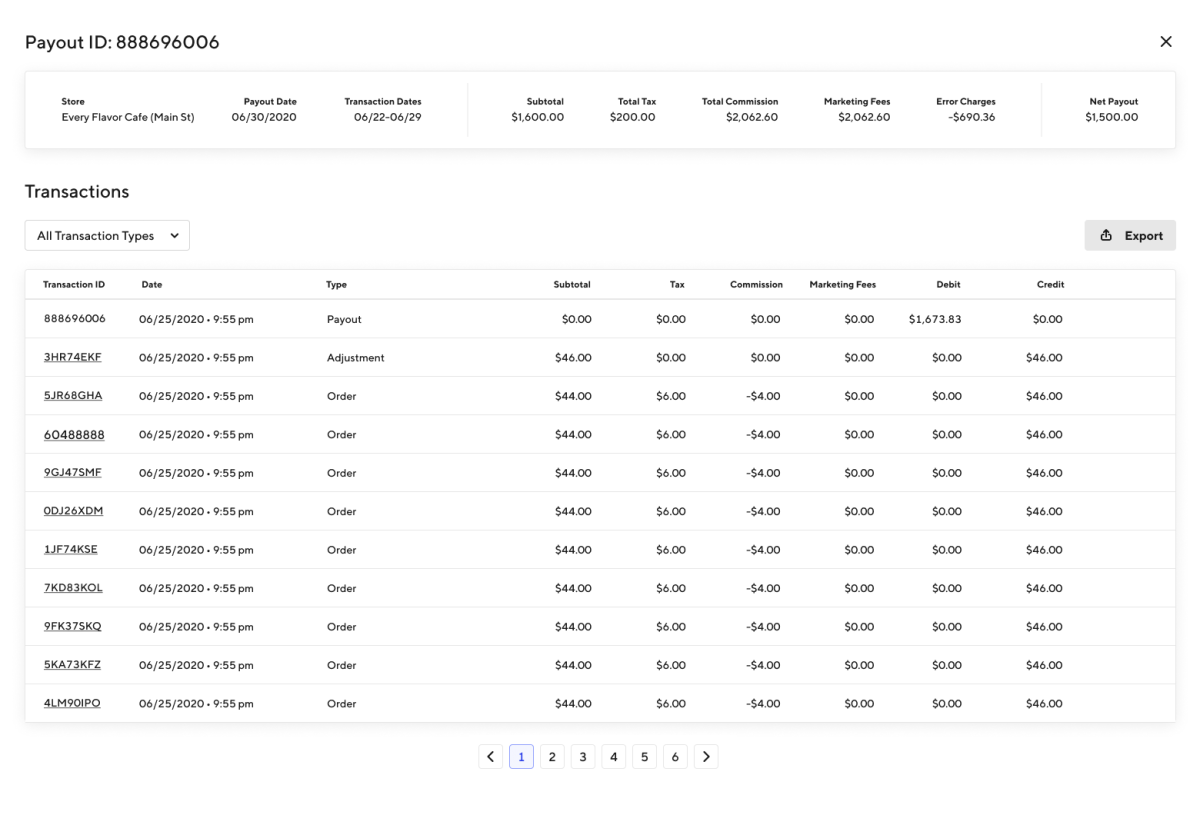

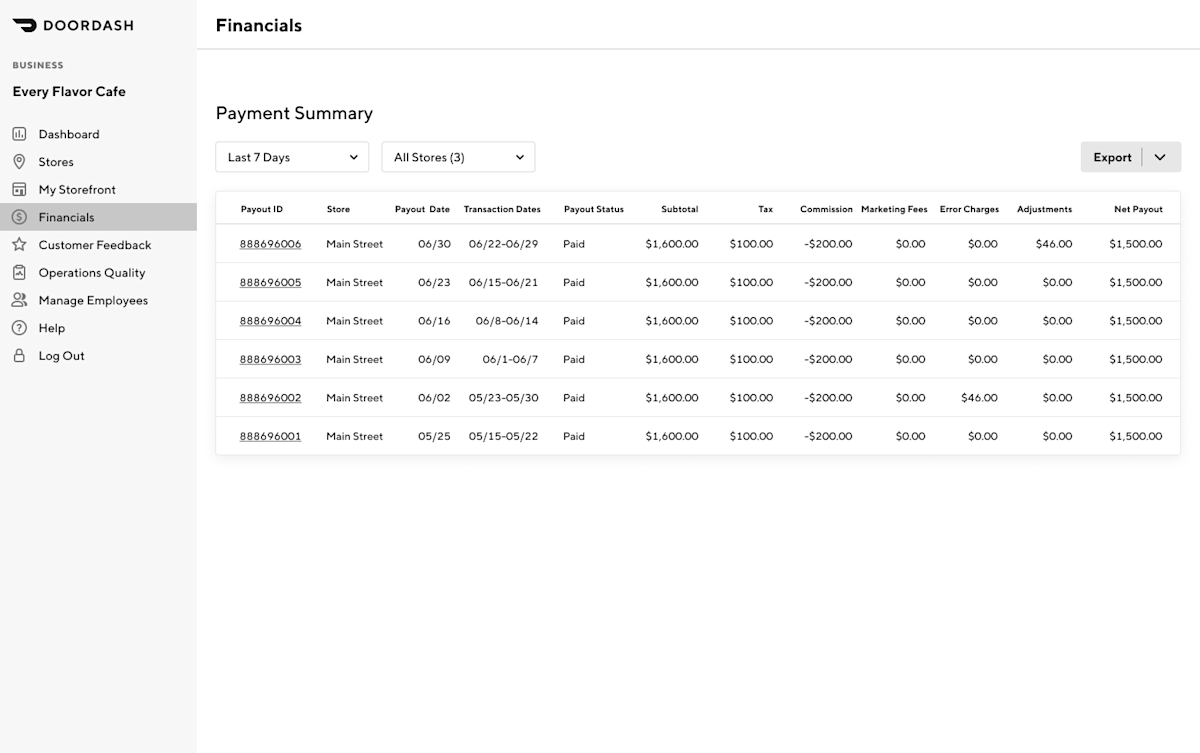

To 630 pm as its the time when the IRS is going to close at 700 pm. February 28 -- Mail 1099-K forms to the IRS OR March 31 -- E-File 1099-K forms with the IRS via FIRE If your store is on Marketplace Facilitator DoorDash collects and remits sales tax on your stores behalf. Elsewhere a court ruling will now let the IRS serve a John Doe summons on crypto prime dealer SFOX letting the agency hunt for possible tax evaders using the companys services.

For more information on Marketplace Facilitator please visit our FAQ here. Some nonprofits have created hotlines where whistleblowers can file an anonymous report of fraud. DoorDash cannot and will not provide tax advice.

The Internal Revenue Service has jurisdiction over individual and business income taxes. Besides many people got lucky to get their calls answered in the later hours like 6 pm. The police will ask for your FTC identity theft report as part of their reporting process and other entities like financial institutions or credit card companies might want the FTC report as well.

TaxSlayer offers four options for completing your tax return online.

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How To Do Taxes For Doordash Drivers 2020 Youtube

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How To Get Doordash Tax 1099 Forms Youtube

Doordash Driver Canada Everything You Need To Know To Get Started

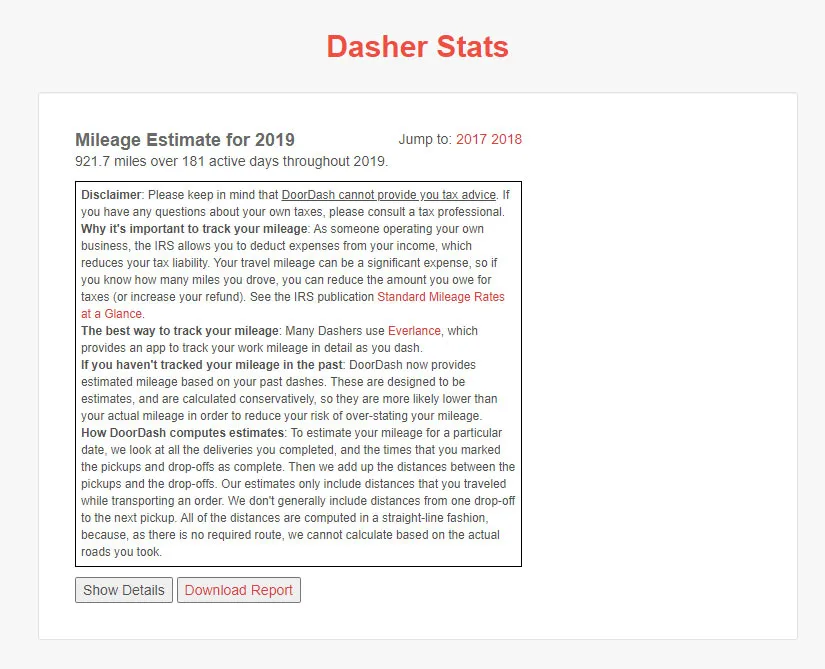

Does Doordash Track Miles How Mileage Tracking Works For Dashers

Prepare For Tax Season With These Restaurant Tax Tips

Prepare For Tax Season With These Restaurant Tax Tips

Prepare For Tax Season With These Restaurant Tax Tips

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash Data Breach 5 Things To Do If You Were Affected

Does Doordash Track Miles How Mileage Tracking Works For Dashers